How to effectively manage your finances during volatile economic periods.

I noticed an economic recession affecting everyone long before we entered the COVID-19 pandemic phase. I’ve talked to my spouse several times about what the greatest solution would be for us and our future financial plans.

Given the current global economic crisis, now is the right time as any to think about money management in tough times.

It’s critical to concentrate on what you can manage. I’ve learnt how to budget and live within my means during these tough times.

Have you given any thought about your finances during this volatile economic period?

Below are a few suggestions that I believe will assist you in managing your money through difficult times.

If you follow this advice and keep your strategy and budget realistic, you just might be able to avoid unpredictable economic downfalls.

1. Know your budget

A budget is usually the starting point for even the most sophisticated financial strategy. The money coming in must be larger than the money going out. Check a few of your bank statements and compare all money coming in and going out. Figure out what can be cut down or cut out if it’s not necessary to have right now. These cuts don’t have to be permanent; instead, try to keep the focus on getting out of this financial mess and keeping you and your family free from a financial breakdown.

2. Make a debt-reduction plan

One of the finest things you can do for your financial condition is to pay down as much debt as possible. Make a strategy to pay off your debts, but first, make a list of all your debt obligations and decide which ones to pay off first. Becoming debt free will really impact your financial plans a lot!

3. Know your earnings

Your salary ultimately determines your lifestyle. If your income is threatened, creating a perimeter around it or finding a new source of it should be a top concern. If necessary, redirect your skills and focus on other ways to earn extra money; there are so many online jobs available now that you can accomplish from the comfort of your own home.

4. Make sure to keep an emergency fund

If doable you should have at least three months’ worth of living expenses in your emergency fund. An emergency fund will help you keep up with bills, debt, rent or mortgage payments, food, and utilities if you lose your job or have your income decreased. This is critical since many things can go wrong during a tumultuous economic moment, including layoffs, job losses, and more!

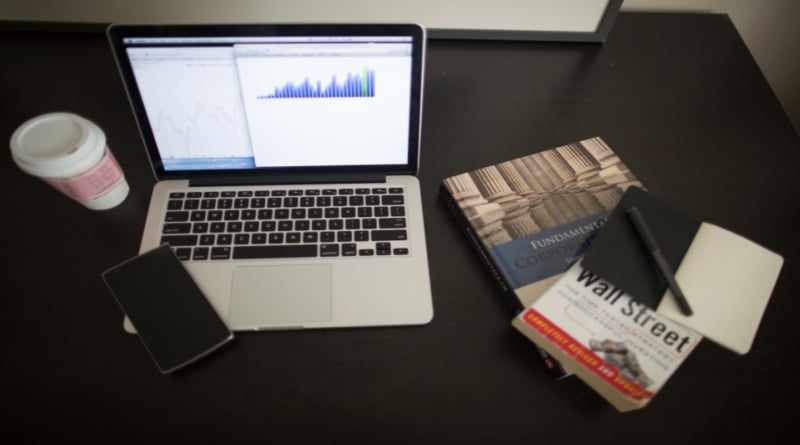

5. Invest

If you’re one of the lucky ones to have already starting to invest, do not stop investing. When prices are high, your investment will buy fewer shares; when prices are low, your investment will buy more shares. This allows for greater growth potential and returns over time. When you can stick to investing for as we know those who participate the longest have the greatest opportunity to succeed.

Last but not least always review your budget and never stop preparing. Take a look at how you’re currently spending your money and see where you can save money.

Even the most accomplished economists can get it wrong when it comes to predicting when a recession will occur and remember there are many institutions like withU that can also assist with loan assistances if needed.

We never know, a loan may be just what someone may need at the time! In today’s world, we all need to be prepared and reorganize our finances whenever we get the opportunity to avoid a significant economic downturn.