A Guide for Crowdsourced Real Estate Investing

Finding the best finance option is a significant concern for investors in various industries. Some methods like getting mortgages or other housing loans may not be so easy or appealing to obtain. That’s why crowdsource real estate investing is becoming more popular than ever because it presents a substantial capital raising opportunity.

It’s also known as property crowdfunding and involves pooling resources from various investors to afford the intended investment. This system allows them to provide substantial capital and even diversify without having to manage the houses personally. So if you’re wondering how crowdsourcing works and what the process is like, read on to find out.

Real Estate Crowdsourcing – How it Works

Crowdsourcing or crowdfunding is a general method of raising funds for any particular purpose. In this case, it’ll be to provide capital for real estate investments. This process differs from other ways of money collection because it allows various qualified individuals to contribute. Most of them require participants to be accredited investors.

The contribution is usually made online through a real estate investment platform like Holdfolio or specific crowdfunding sites. The ease of raising funds using this method is part of what makes it well-sought, though it’s not a traditional means. Developers or potential investors for a project use it to seek people with interest and the right resources to add.

Types of Real Estate Crowdsourcing

There are two types of real estate crowdsourcing based on the option of investments. They’re equity and debt.

-

Equity

Equity investments are more common because of the higher returns they provide. Unfortunately, that also means they pose more risks to the investors than the other type of crowdfunding. However, it gives them an equity stake in the property obtained, and each person gets a share of the returns from the rents paid. Also, there’s a more extended holding period, so it offers less liquidity.

-

Debt

Debt investments allow the owner of the property to borrow money from the investors. Thus, each person gets a fixed rate of returns based on loan interests and the amount invested. That means the income is steady, and it poses less risk than equity. There’s also a shorter holding period which presents more liquidity, but there’s a cap on the yields.

Getting Involved in Crowdsourced Investing

Getting involved in real estate crowdsource investing is a straightforward process. Nevertheless, you must know the steps to take and consider them appropriately before making a move. We’ll highlight them below.

-

Find a Reputable Platform

There are several crowdsourcing platforms, so choosing one requires good decision-making skills. Even if you want to start real estate crowdfunding with Holdfolio or sites like iFunding and Fundraise, it’s best to do your due diligence before starting. You must conduct proper research to know the credibility of the site, its investments, and its service quality.

-

Ensure You Understand the Modalities

Crowdsource real estate investing means you’re joining others to pool resources for capital. So you most likely won’t be directly involved with the property, but it’s essential to keep abreast of everything that’s happening. Get information when necessary, and don’t hesitate to ask questions to know what you should do.

-

Invest Your Money

After finding a good platform and learning the process, the next step is to put in your capital fund. Note that crowdfunding is one way to invest in real estate with little money, so it’s not mandatory to contribute massive amounts. Also, put in a fair percentage of your wealth or income and let it grow instead of putting all your resources in at once.

Benefits of Crowdsource Real Estate Investments

Investing in real estate through crowdsourcing provides several benefits for the investors and everyone involved. There are specific advantages to enjoy even though one doesn’t outrightly own property. We’ll discuss some of them subsequently.

-

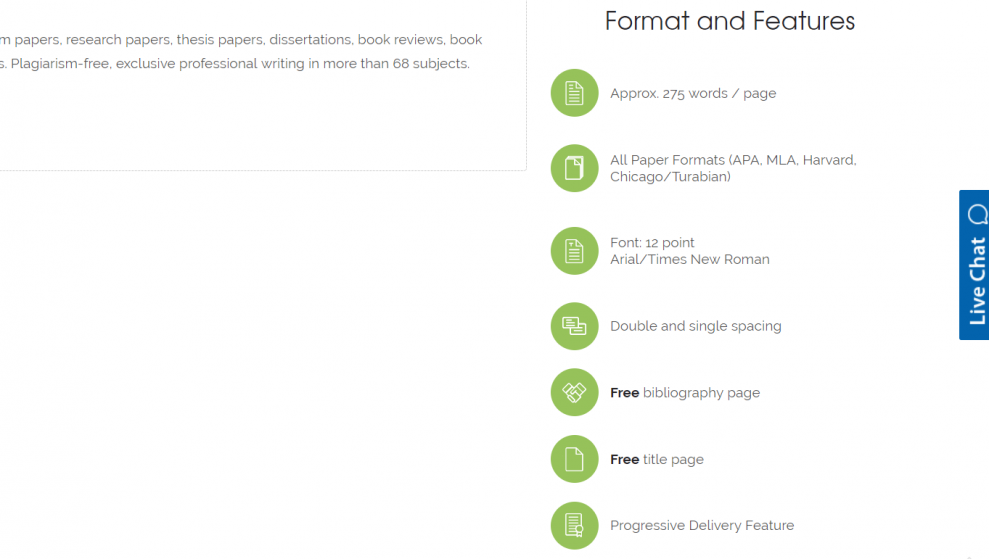

Simple Methods

The actual process of crowdfunding or crowdsourcing for real estate investment is usually simple. The platforms differ, but they’re generally designed to be user-friendly and easy to navigate. Therefore, becoming an investor is as straightforward as clicking on a few icons on your phone or laptop. It also helps to bypass the traditional fundraising methods.

-

Access to Capital

Besides the simplicity, it provides easy access to real estate investment capital. Typically, one would have to apply for loans or go through various other means that may be frustrating or have high-interest rates. Now people seeking such funds don’t need to go through all that, and that’s why some individuals even apply it to businesses.

-

Provides a Marketing Platform

Investors who promote their real estate opportunities through crowdfunding platforms get free marketing in a sense. That’s because as the campaign gets popular, more people get to know about the investment or project. It provides a specific exposure that they may not achieve with other fundraising methods.

Drawbacks of Crowdsource Real Estate Investments

Understanding the drawbacks provides a guide for investors seeking the best crowdfunding real estate opportunities. That’s why it’s essential to get balanced knowledge so that you can anticipate and tackle or avoid these issues. We’ll highlight these disadvantages below.

-

There are Risks Involved

Risks are normal when talking about investments, but they might be more pronounced in such opportunities. That’s because the investors may be random people who may not be confident in the endeavor. There may also be a long holding period before getting returns on investment, and most people don’t like that.

-

No Decision-Making Capacity

Crowdsourced investors don’t have the capacity or authority to make any decisions regarding the investment. That’s because they’re only contributors to the funds or capital. This lack of controlling power is what makes some people opposed to such campaigns. So it’s essential to find out about each investment opportunity before getting involved thoroughly.

Conclusion

You can understand now that crowdsource real estate investing is beneficial for various reasons. That’s why some investors recommend it as an excellent way to provide investment capital and earn without owning property. It’s a straightforward process, but you must endeavor to make adequate findings before starting with any platform.