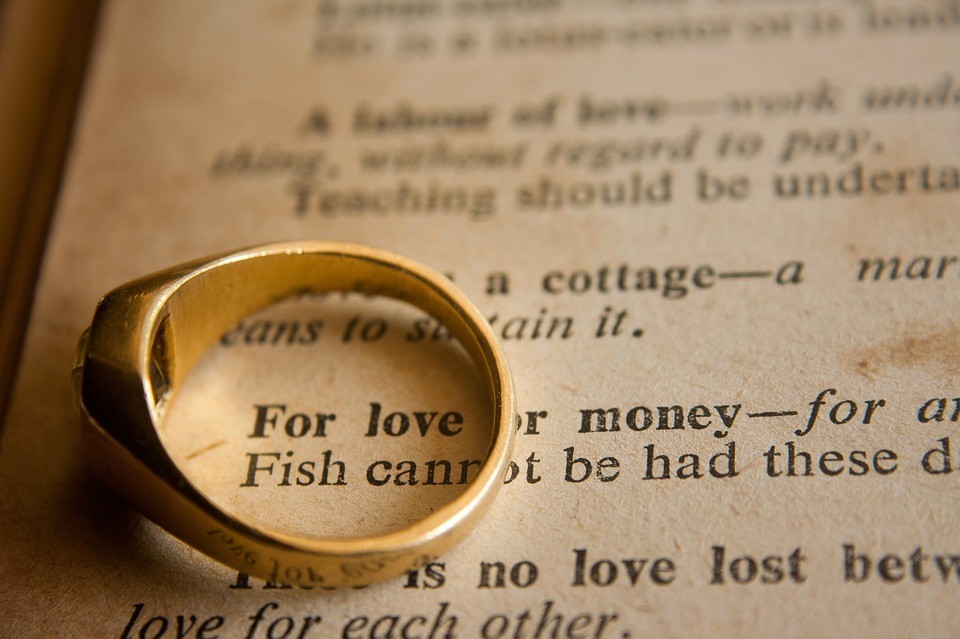

Smart Clues for Couples and Their Finances until Death Do Them Part

Image Credit

Finances are one of the least romantic things you can talk about with your partner. Unfortunately, it’s a reality that every single couple needs to deal with. When you enter into a serious relationship with someone, your financial situations enter into a relationship as well. This can make things complicated, especially if things don’t end up working out in the end. That’s why it is so important to get everything in order as soon as you can. Use the tips in this article to make sure your financial affairs are in order and you can get back to the romantic, fun stuff!

#1 Consider Keeping Separate Bank Accounts

After marriage or even after moving in together, some couples will choose to get joint accounts, completely merging all of their finances. This definitely has its advantages. But there are also some advantages to keeping separate accounts. The best option will be different for each couple. So this is something that you will want to talk openly and honestly about with your partner.

#2 Create Budgets Together

Both of you have your own ideas about where your money should go. And if you don’t talk about it in advance and on a regular basis, you are inevitably going to reach a point where one of you does something with your money that upsets the other. You can avoid fighting over finances by getting your plans set in advance.

Whether or not you decide to combine your accounts, you do still manage a household together and do still have a future to plan together. Even with separate accounts, you need to be in agreement about how to pay for your lifestyle and for the future that you want.

#3 Get Your Paperwork in Order

Whether you are married or civil partners, there are a lot of documents you need to get in order to make sure that your assets are handled the right way in case of any emergency or change of the situation. You will want to work with a team of professionals like the one at Russells to make sure you don’t leave a single loose end.

#4 Remember that Secrecy & Privacy are Different

While there is absolutely nothing wrong with keeping separate accounts, you really do need to be above board about everything. This is part of why you need to budget together. Plan out your expenses and then divvy them up according to whatever system you prefer. Any money left over after you have got your bills paid, your savings account funded, and your investments under control is yours to spend.

But don’t let your joint expenses suffer for the sake of maintaining privacy. And don’t be secretive about how you spend your money. As long as the priority expenses are covered, there’s no reason to hide the “frivolous” things you like to spend money on. And the same works the other way round. If your expenses are handled, there’s no reason to judge your partner for the “frivolous” things they enjoy spending money on.

Final Word

A lot of issues can be avoided before they become a problem if you use the tips you read about above in this article. However, in some cases, no matter how careful you are, there will still be problems that you just can’t resolve. In those cases, you need to make sure you find a great lawyer. Even if you think the process is going to be straightforward, you want to make sure all your bases are covered. It’s better to be more prepared than you need to be than to not have prepared enough!

We have our own accounts but are in constant communication. We both came into a relationship with a lot of debt and we worked hard to become debt free. We just bought our first new home together and move into it in July.

These are good tips. My husband and I were just married and we have also talked about how we’re going to manage our finances. We have decided to each keep a personal bank account and have a merged one separately where we will contribute a % of our income monthly.

I’ve always been the one to run the accounts, and it’s always worked for us! We have shared accounts, and the idea of having separate accounts is just strange for my husband and I.

We’ve always had a budget. I feel it’s the vehicle that keeps us in order and not going overboard.

I would never have a separate account from my husband. I think that is just asking for separation in a marriage and family. I think the best tip is to sit down TOGETHER and budget and be open with spending, needs and wants. Doing this monthly keeps those secrets NOT secrets.

It is such an important thing to sit down together and discuss finances thoroughly so that you avoid any financial conflicts. These are great clues.

My husband and I have had separate bank accounts since we have met. It just makes sense for us and makes things a whole lot easier to keep up with. Great tips.

These are important tips for smooth finances for couples. It’s amazing how many couples don’t figure out the finance aspect of a relationship. My husband and I are both like-minded in that we like to save a lot. I will incrporate some of your fabulous tips!

My husband and I do create budgets together. We have monthly budgets that we set. Since neither of us have set paychecks every month, it is very helpful for us to budget together.